Thinking about remortgaging? This guide will walk you through what remortgaging means, the steps you need to take, and how it can help you secure a more favourable deal.

In today’s blog post, we’re going to delve into the world of remortgages, explaining what they are and how they work. Whether you’re a homeowner looking to optimize your mortgage or simply curious about the process, we’ve got you covered.

So, let’s get started!

What Is A Remortgage?

A remortgage is the process of switching from one lender to another with the primary aim of securing a better deal. Homeowners often choose to remortgage to ensure that their mortgage aligns with their evolving financial needs and lifestyle. In today’s ever-changing market, it’s still possible to find a remortgage deal that suits your circumstances.

Why Consider A Remortgage?

Many homeowners in the UK opt for remortgaging each year, driven by various reasons:

It’s worth noting that remortgaging is not a one-size-fits-all solution, and you can pursue it for any valid reason that suits your needs.

- Expiring Deal: If your existing mortgage deal is about to end, you might want to avoid transitioning to the lender’s standard variable rate, which typically results in higher costs. Remortgaging allows you to secure a new deal with more favorable terms.

- Increased Property Value: Over time, the value of your home may appreciate. This increased equity can be tapped into through remortgaging, providing funds for essential repairs or even home improvements.

- Debt Consolidation: Some homeowners choose to remortgage to consolidate personal debts, which can provide relief from mounting financial pressures. However, it’s crucial to consider the implications of securing debts against your home.

- Flexibility: Remortgaging can grant you more flexibility. For instance, you may seek a deal that allows for overpayments without penalties, enabling you to pay off your mortgage faster.

- Cost Reduction: Lowering monthly mortgage repayments is another goal of remortgaging. This can be achieved by either securing a better interest rate or extending the mortgage term, though the latter may increase the overall interest paid.

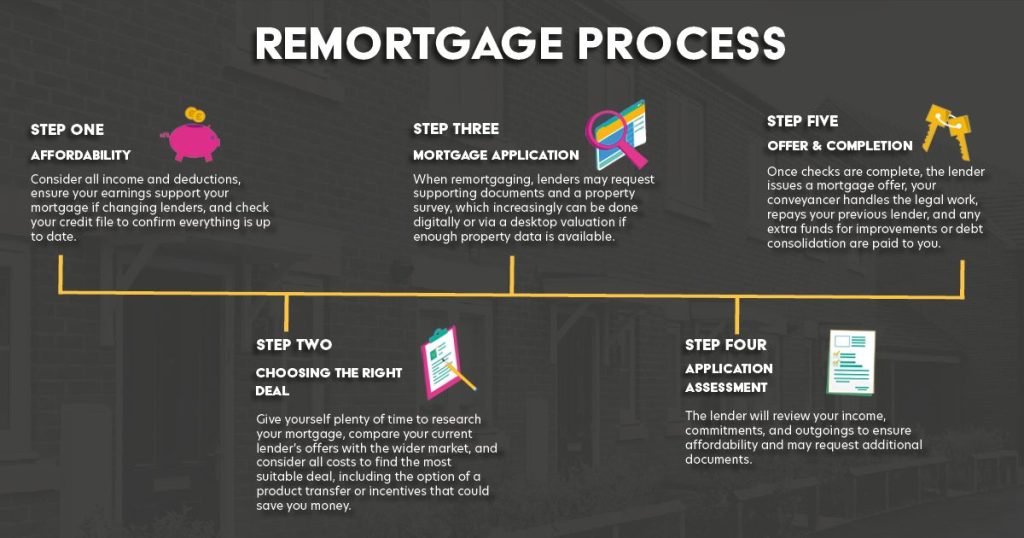

The Remortgage Process Step By Step

Step 1: Determine Affordability

Now that you understand some of the motivations behind remortgaging, let’s break down the process into manageable steps:

Before diving into the remortgage process, assess your affordability. Knowing your financial limits is essential to ensure that you secure the right deal.

Step 2: Research Your Options

Research your existing lender’s offers as well as competitive rates available in the market. Sometimes, staying with your current lender and selecting a new rate (known as a Product Transfer) can be cost-effective.

Step 3: Choose the Right Deal

Consider your long-term plans, such as whether you’ll be moving soon or if you prefer the certainty of fixed mortgage repayments. Your decision should align with your specific circumstances.

Step 4: Mortgage Application

Similar to buying a property, the lender will require details from you. Some lenders now use digital processes, potentially speeding up the valuation survey.

Step 5: Lender Assessment

The lender will assess your income, commitments, and outgoings to ensure the mortgage is affordable. Additional documentation may be requested during this stage.

Step 6: Receive the Mortgage Offer

Once your property and financial situation are deemed suitable, the lender will issue a formal mortgage offer. If you’re changing lenders, your solicitor will handle the necessary paperwork.

Step 7: Completion

This final step involves transferring the property charge to the new lender, and your new mortgage payments will begin. If you’re raising additional funds, this is when you’ll access those funds.

In conclusion, remortgaging is a valuable financial tool that can help you secure a better mortgage deal, access funds for various purposes, and adapt to changing circumstances. While we’ve covered the basics here, remember that each person’s situation is unique, so it’s essential to consult with a mortgage expert and thoroughly research your options.

For even more detailed information and guidance on remortgaging, check out our FREE Remortgage Guide.

If you have any questions or need assistance, feel free to drop a comment or contact our team at 01925 573 328.

Disclaimer

UK Mortgage Centre Limited is an Appointed Representative of Refresh Mortgage Network Limited. Refresh Mortgage Network Limited is authorised and regulated by the Financial Conduct Authority. We are entered on the Financial Services Register under firm number 1019794.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments. The Financial Conduct Authority does not regulate some forms of buy-to-let mortgages.

The Financial Conduct Authority does not regulate will writing and taxation and trust advice.

You may be charged a fee for your advice. A typical fee is £495, which would be payable when you receive your mortgage offer. Your dedicated advisor will discuss this further on your free initial phone call.

Registered company number: 15825320